Posts

Citibank has to offer an excellent $325 incentive to possess beginning an eligible bank account and you can to make two or more being qualified head deposits totaling at the very least $3,100000 within this 90 days. SoFi frequently also provides a monitoring and deals incentive, and its own latest render are solid regarding the prior offerings, according to all of our lookup. The bank gets the second-fastest award schedule from the banking companies on the our very own checklist — so it extra can also be arrive when 32 days immediately after a qualifying head deposit are acquired. For individuals who’re also trying to get a bank checking account, make sure that they’s a matches that suits your circumstances. Including, if you would like have fun with branches and ATMs, double-check that there are plenty of him or her close by.

The accounts incorporated about this listing is FDIC- or NCUA-insured up to $250,000. Which render is most effective in order to consumers whom focus on in the-individual banking, Automatic teller machine entry to and you will financial during the one to institution more than earning highest desire to their deals. Chase are a professional stone-and-mortar option, specifically if you well worth within the-person financial and you will customer support. You’ll gain access to 15,000+ fee-100 percent free ATMs in the nation and you can a wide range of financial, borrowing and you will spending features. Since the biggest lender from the U.S., Chase is known for its vast bodily footprint, greater Atm circle and you will available support service. You’ll find almost every other membership for the all of our number having much higher bonuses, but you’lso are unlikely to locate an offer this easy to earn.

You could demand an advantage discount when deciding to take with you to the a great Pursue department to open the new account and you will receive the incentive. A good travel cards with a good welcome provide, an excellent advantages, and you can rewards for a moderate annual fee. People who are looking a straightforward family savings because of Chase will be discuss the new Pursue Complete Savings account. You’ll provides several options dependent on your debts and you will tastes. If you’lso are a student otherwise an army representative, you’ll discover special account that will be designed specifically for the means.

Nội dung bài viết

PNC Lender

MarketWatch Courses could possibly get found compensation from companies that appear on it webpage. The newest compensation could possibly get impression exactly how, where plus exactly what purchase items appear, but it does perhaps not determine the recommendations the new article party provides. Deposits is generally covered to $3M due to participation regarding the program. Find list of acting banks during the SoFi.com/banking/fdic/participatingbanks.

As to the reasons banking companies features sign-upwards bonuses

Yes, you can receive numerous financial bonuses by appointment render standards in the multiple lender. Particular bonuses require extreme stability or particular head put minimums. Make sure to investigate terms and conditions prior to signing upwards for an account to ensure you’ll indeed be able to get the bonus. Consider the fees you may need to pay, if your’ll manage to fulfill lowest equilibrium requirements, exchange limits, Atm availability plus the customer service given. Install direct put and receive at least $5,100000 in direct deposits inside two months. Head places need to be paychecks, pension inspections, Societal Defense money and other typical monthly money.

- By signing up for a monitoring otherwise bank account (or both), I will earn a few hundred bucks out of Pursue.

- Possibly, a lending institution tend to get in touch with visitors in person from post.

- Which differs from bank card incentives, where cardholders usually have to satisfy a paying requirements to earn the benefit, being qualified it additional money as the rebates, not money.

- Should you choose need a fee-free bank account, here are a few the listing of a knowledgeable no-fee checking profile.

- An informed bank promotions offer the possibility to earn a critical dollars bonus to own signing up for a different membership without fees or charge which might be simple to get waived.

Officially, no, the fresh account doesn’t features minimal harmony requirements. To earn the fresh $3 hundred savings account incentive, you need to discovered $step one,one hundred thousand or more inside the qualifying digital places in the first 90 days. For those who look after you to equilibrium to have ninety days, your own APY are effectively 185.61%.

Does Chase Total Examining have at least harmony requirements?

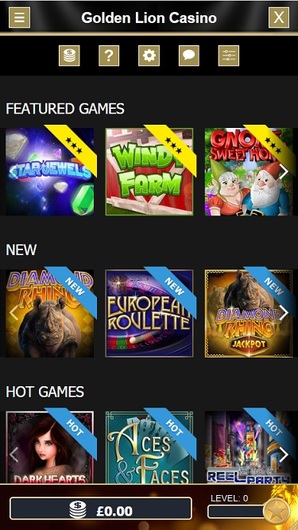

That it bank may also provide almost every other https://mobileslotsite.co.uk/no-card-details/ advertisements now; see more Huntington Financial bonuses. So it financial can also give other campaigns at this time; find much more Pursue Bank incentives. GOBankingRates’ article team is actually dedicated to providing you with objective reviews and guidance.

Meaning your own productive APY will be 102.47% to have $step 1,100 directly in dumps and you may drop to help you 15.47% to own $4,999.99 directly in deposits. All the consumer offers accounts are eligible because of it added bonus except for Dvds and offers membership from Wells Fargo Personal Lender. You ought to open your checking account in the a good Wells Fargo part discover it bonus, and also the offer ends for the Jan. 8, 2025. The bonus will be placed into your account within this 1 month once you satisfy all the standards. Once you secure a checking account incentive, one to extra cash is taxed since the earnings.

And standard FDIC insurance rates, SoFi now offers more insurance policies around $step three million. Open a good 360 Family savings to your or just after August 22, 2024, playing with coupon code CHECKING250. Here are some far more what things to be cautious about regarding a financial sign-upwards extra. Thomas J Catalano try a good CFP and you will Inserted Investment Adviser which have the condition of South carolina, in which he revealed his or her own financial consultative company in the 2018. Thomas’ feel gives your experience with many portion in addition to assets, old age, insurance policies, and you will monetary considered.

- To make both membership incentive, you should found being qualified lead dumps from the Jan. 31, 2025.

- After you meet up with the added bonus requirements, the bucks would be transferred on your membership in this thirty days.

- Yes, you can make incentives to own starting a new Pursue family savings, along with referring family members.

- For individuals who’lso are looking for large-give offers profile and you will Dvds along with zero-payment checking, believe going through the finest on the internet financial institutions.

- To meet the requirements you should not getting a recent Chase Lender customers and possess not finalized a merchant account which have Pursue within the last ninety days.

Take the time to consider all your alternatives and check out our very own listing of the fresh easiest banks in the U.S., specifically if you like the big brick-and-mortar banks. Pursue Overdraft Assist does not require enrollment and has eligible Chase checking account. If you wear’t qualify away from a bank account venture, your acquired’t secure the main benefit. However, you could potentially generally continue using the brand new membership and just about every other rewards you’re-eligible to own. To earn the higher $600 Platinum Rewards Examining bonus, you should put no less than $25,000 and sustain the new membership open for at least 3 months.

That which we such from the Chase Overall Examining

He made their undergraduate degree from Ny University.Taylor has completed the education demands on the University away from Texas in order to qualify for a certified Monetary Planner degree. If you’re searching for large-yield deals membership and you may Dvds as well as zero-commission checking, believe going through the better on line banking companies. A couple of, provides at the very least $twenty-five in total repeated automated transfers from your own Pursue checking account.

Financial Altitude Wade Charge Signature Card now offers 20,100 added bonus items (redeemable to own $200) once you purchase $step one,100 in this ninety days away from opening your bank account. To earn a complete $300 SoFi Examining and you can Offers extra, you would like at least $5,100 inside the being qualified lead dumps inside the twenty five-time added bonus several months. SoFi doesn’t identify if or not you ought to look after you to put amount for the whole 25-go out extra several months, but if you do, your own effective APY was 132.2%.

What is actually membership churning, as well as how will it interact with bank bonuses?

JPMorgan Pursue Bank happens to be providing a bonus from $three hundred once you discover an individual checking account and you can $two hundred after you unlock a savings account. For those who discover each other membership meanwhile, you get a supplementary $400 — to possess a total added bonus from $900. Chase Private Consumer Examining offers a plus all the way to $step three,100 to possess opening a new membership. Investigate campaign facts above to know all legislation and conditions to make the fresh checking account extra, and a super high minimum transfer number which can never be sensible.